We live in an era where everyone is selling a magic wand. Turn on the news, open your email, or scroll through LinkedIn, and you will see the same promise: Artificial Intelligence will fix everything. They say it will write your emails, manage your customers, and perhaps even brew your coffee. But as a business owner, you know that “cool” does not pay the bills. Profit does.

The problem is not that small businesses are refusing to use these tools. The problem is that many are using them without a calculator. You might sign up for a $30 monthly subscription here and a $500 implementation fee there. It feels small. But when you look at your Profit and Loss (P&L) statement at the end of the year, those small leaks can sink the ship if they aren’t pumping value back in.

This brings us to the most critical question of 2025: How do you calculate AI ROI?

It is not enough to just “feel” more productive. You need hard numbers. You need to know if that chatbot is actually selling products or just annoying your customers. You need to know if your AI writing tool is saving you hours or just creating more editing work.

In this guide, we are going to move beyond the hype. We will strip away the marketing buzzwords and look at the cold, hard math. We will walk through the formulas, the hidden costs that sales reps won’t tell you about, and the “soft” benefits that actually drive long-term value. By the end of this article, you will have a clear framework to measure the AI ROI of every tool in your tech stack.

The Main Equation: The Fundamentals of AI Valuation

Before we open a spreadsheet, we must understand the fundamental equation. In business school, we learn complex ways to value assets, but for a small business looking at software, the core concept of AI ROI is simple.

The standard formula for Return on Investment (ROI) is:

If you spend $1,000 on a tool and it generates $5,000 in new value, your calculation looks like this:

($5,000 – $1,000) / $1,000 = $4. Multiply that by 100, and you have a 400% ROI.

This looks easy, right? But here is where most business owners get it wrong. They mess up the “Total Costs” part. They only plug in the price of the software subscription. They forget that buying a car is cheap, but driving it costs gas, insurance, and maintenance. This therefore alters the AI ROI calculation.

CapEx vs. OpEx in the AI World

To get the math right, you have to think like a CFO. In the world of accounting, we split costs into Capital Expenditures (CapEx) and Operational Expenditures (OpEx).

-

CapEx (One-time costs): This is the money you spend once to get the system running. It might include paying a consultant to set up your AI automation or buying a new server if you are running a local language model for privacy.

-

OpEx (Ongoing costs): This is the monthly bleed. It includes your ChatGPT Team subscription, the API fees for your custom agents, and the salary of the employee who manages the tool.

When you calculate AI ROI, you must include both. If you ignore the time it took to learn the tool, you are artificially inflating your AI ROI. You are lying to yourself about how profitable the tool is. Real data integrity demands that we look at the whole picture.

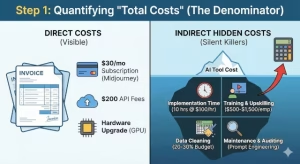

Step 1: Quantifying the “Total Costs” (The Denominator)

Let’s build the denominator of our fraction. To accurately calculate AI ROI, you need to hunt down every single dollar leaving your bank account related to these projects.

The Direct Costs

These are the easiest to track because they show up on your credit card statement.

-

Software Subscriptions: This is the obvious one. Whether it is Midjourney for images ($30/month), Jasper for writing ($49/month), or a customer service bot like Intercom Fin ($0.99 per resolution), you need to tally these up annually.

-

API Usage Fees: If you are a slightly more advanced business, you might be using the OpenAI API to feed data into your own spreadsheets. These costs are variable. One month it might be $10; the next it might be $200 if your usage spikes.

-

Hardware Upgrades: Most AI is in the cloud, so you usually don’t need new computers. However, if you are a video editor using AI rendering tools on your local machine, you might need a better graphics card (GPU). That cost belongs in your AI ROI calculation.

The Indirect Hidden Costs (The Silent Killers)

This is where your AI ROI usually takes a hit. These are the costs that do not have a clear invoice but cost you money nonetheless.

Implementation Time

How long did it take you to set up the tool? Let’s say you bought an AI CRM assistant. You spent 5 hours connecting it to your email and 5 hours testing it. That is 10 hours.

If your time is worth $100 an hour, that is a $1,000 hidden cost. If you don’t factor this in, you might think you broke even in month one, when you actually are still in the red.

Training and Upskilling

This is the “learning curve” tax. If you hand your marketing manager a new AI tool, they are not going to be productive immediately. They will spend hours watching YouTube tutorials, reading documentation, and experimenting.

-

The Math: If an employee makes $30/hour and spends 10 hours learning the tool, that is a $300 investment.

-

The Reality: In 2025, training costs are estimated to be around $500 to $1,500 per employee for robust AI integration.

Data Cleaning

AI is like a sports car; it needs high-quality fuel. If you feed it “dirty” data, messy customer lists, duplicate emails, inconsistent formatting, it will crash.

Small businesses often underestimate this. You might spend 20 hours fixing your Excel sheets before you can even upload them to the AI. That time is a massive cost. In larger projects, data cleaning can consume 20-30% of the total budget.

Maintenance and Auditing

AI is not “set it and forget it.” It is more like “set it and watch it like a hawk.”

-

Prompt Engineering: You will constantly need to tweak how you talk to the AI to get good results.

-

Output Auditing: You cannot blindly trust AI. It hallucinates. A human must review the work. If your copywriter uses AI to write a blog but spends 2 hours fact-checking it, you only saved the difference between writing and editing. You did not save the whole time block.

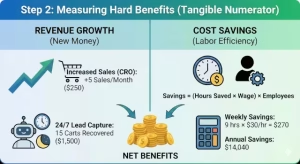

Step 2: Measuring Hard Benefits (The Tangible Numerator)

Now for the fun part: the money coming in. To prove a positive AI ROI, we need to find the specific dollars that this technology generated or saved. We call these “Hard Benefits” because they are tangible and indisputable.

Revenue Growth

This is new money that you would not have made without the AI.

Conversion Rate Optimization (CRO)

Let’s say you run a local bakery website. You use AI to rewrite your product descriptions to be more persuasive.

-

Before AI: 1,000 visitors = 20 sales (2% conversion).

-

After AI: 1,000 visitors = 25 sales (2.5% conversion).

-

The Gain: Those 5 extra sales are direct revenue attributable to AI. If each cake is $50, the AI made you $250 this month.

24/7 Availability (The Chatbot Factor)

If you install an AI agent on your website, it works while you sleep.

-

Scenario: A customer visits your plumbing site at 11:00 PM with a leaking pipe.

-

Without AI: They call, get voicemail, and leave to call a competitor.

-

With AI: The bot answers, books an appointment for 8:00 AM, and secures the lead.

-

The Value: The value of that job (e.g., $300) is 100% attributed to the AI.

Cost Savings (Labor Displacement vs. Augmentation)

This is the most common way to calculate AI ROI for small business. You are saving time, and time is money.

The Savings Formula

Example:

Imagine you have a bookkeeper who spends 10 hours a week manually entering invoices. You subscribe to an AI tool that scans PDFs and extracts the data automatically.

-

New Workflow: The bookkeeper now spends only 1 hour reviewing the work.

-

Hours Saved: 9 hours per week.

-

Wage: $30/hour.

-

Weekly Savings: $9 X $30 = $270.

-

Annual Savings: $270 X 52 weeks = $14,040.

If the software costs $100/month ($1,200/year), your AI ROI calculation is:

That is a phenomenal return.

Risk Mitigation

This is harder to see but valuable. What is the cost of not making a mistake?

-

Contract Review: If you use AI to scan a vendor contract and it spots a clause that would have cost you a $5,000 fine, that is $5,000 in value.

-

Compliance: For industries like finance or healthcare, AI can flag non-compliant emails before they are sent, saving you from potential lawsuits.

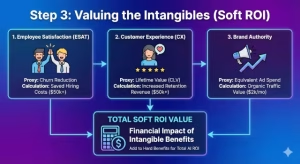

Step 3: Valuing the Intangibles (The “Soft” ROI)

Most articles stop at the hard numbers. However, the biggest value often lies in the “soft” metrics. These are harder to put on a spreadsheet, but they are vital for long-term survival. We call this “Soft AI ROI.”

Employee Satisfaction (ESAT)

Nobody likes drudgery. Nobody likes copying and pasting data from one tab to another for four hours a day. When you use AI to remove these boring tasks, your employees are happier.

How to value this:

Use “Churn Reduction” as your proxy metric.

-

It costs about 50% to 200% of an employee’s salary to replace them (recruiting fees, training, lost productivity).

-

If you have 10 employees and you usually lose 2 a year, that costs you tens of thousands of dollars.

-

If AI makes their jobs 20% more enjoyable and you only lose 1 employee this year, you have saved that replacement cost. That is real money saved.

Customer Experience (CX)

Customers in 2025 expect instant answers. They do not want to wait 24 hours for an email reply.

How to value this:

Use “Customer Lifetime Value” (CLV).

-

Scenario: You use AI to personalize your email newsletters. Instead of a generic blast, every customer gets product recommendations based on what they bought last time.

-

Result: Customers feel understood. They stick around longer.

-

The Math: If your average customer usually stays for 12 months paying $50/month ($600 CLV), and AI personalization keeps them for 13 months ($650 CLV), you have gained $50 per customer.

-

Multiply that by 1,000 customers, and you have added $50,000 in value to your business.

Brand Authority and Velocity

In the world of SEO, speed matters. Google likes fresh content.

How to value this:

Use “Equivalent Ad Spend.”

-

If you use AI to help you write 4 high-quality blog posts a week instead of 1, your organic traffic might double.

-

Look at how much that traffic would cost if you bought it via Google Ads (Cost Per Click).

-

If you gain 1,000 organic visits and the CPC for your keyword is $2.00, your content strategy just generated $2,000/month in equivalent advertising value.

Real-World Scenarios: The Math in Action

To make this concrete, let’s run through two full scenarios using our formulas.

Scenario A: The Service Business (The Marketing Agency)

The Business: A small digital marketing agency with 5 employees.

The Investment: They buy a suite of AI tools for copywriting and graphic design.

-

Midjourney & ChatGPT Team: $600/month.

-

Training: They spent $2,000 upfront training the team.

The Returns (Monthly):

-

Labor Savings: The writers are producing content 3x faster. They saved 40 hours of junior writing labor per month. ($40 hours X $25/hr = $1,000).

-

New Revenue: Because they are faster, they took on 2 extra clients without hiring new staff. ($2,000/month profit per client = $4,000).

The Calculation (First Year):

-

Total Costs: ($600 X 12 months) + $2,000 (training) = $9,200.

-

Total Benefits: ($1,000 labor savings + $4,000 new revenue) $\times$ 12 = $60,000.

-

Net Benefit: $60,000 – $9,200 = $50,800.

-

AI ROI: ($50,800 / $9,200) X 100 = 552%.

Verdict: A massive success. The AI ROI is undeniable.

Scenario B: The Retailer (The E-commerce Store)

The Business: A boutique clothing store selling online.

The Investment: An AI Customer Support Agent to handle returns and sizing questions.

-

Software Cost: $200/month.

-

Setup Fee: $500 one-time.

The Returns (Monthly):

-

Recovered Carts: The bot talks to people who are about to leave the site. It saves 5 carts a month that would have been lost. Average cart value is $100. (5 X $100 = $500).

-

Labor Savings: The owner spends 5 fewer hours a week answering emails. (20 hours/month X $50/hr owner value = $1,000).

The Calculation (First Year):

-

Total Costs: ($200 X 12 months) + $500 = $2,900.

-

Total Benefits: ($500 cart recovery + $1,000 labor savings) X 12 = $18,000.

-

Net Benefit: $18,000 – $2,900 = $15,100.

-

AI ROI: ($15,100 / $2,900) X 100 = 520%.

Verdict: Even for a tiny team, the AI ROI is huge because it frees up the owner’s valuable time.

Trends & The Future of AI ROI

As we look toward the rest of 2025 and into 2026, the way we calculate AI ROI is shifting. We are moving from “Chatbots” to “Agentic AI.”

The Rise of Agents

In 2023 and 2024, we mostly used AI to generate things, text, images, code. In 2025, we are using AI to do things. Agents can browse the web, book flights, send invoices, and update CRMs autonomously.

This increases the “Labor Savings” multiplier. An agent doesn’t just help you write an email; it sends the email and files the response. This means the potential AI ROI for small businesses is about to skyrocket, provided you can handle the implementation complexity.

The GenAI Divide

However, there is a warning trend: The “GenAI Divide.” Data shows that while 80% of businesses are testing AI, only about 5% are seeing massive structural changes to their P&L. Why? Because the others are stuck in “Pilot Purgatory.” They test a tool, play with it, but never fully integrate it into their daily workflow.

To be on the winning side of this divide, you must move from “playing” to “deploying.” You must commit to the training and the data cleaning. The AI ROI only appears when the tool becomes a boring, reliable part of your business infrastructure.

Common Questions about AI ROI

Many small businesses have the same questions over and over. Here are the answers to the most common queries regarding AI ROI.

What is a good ROI for AI in small business?

Generally, you should aim for a 3x to 5x return (300-500%) within the first 12 months. Because AI technology moves so fast, a tool that only breaks even is actually a loss, because by the time you master it, a better one will exist. Therefore, you have to retrain again. You need high returns to justify the agility required.

How long does it take to see ROI from AI?

For productivity tools (like writing assistants), the AI ROI is almost immediate, often within the first month. For complex integrations (like customer service bots or predictive analytics), expect a ramp-up period of 3 to 6 months before the data is clean enough to show a profit.

Can AI ROI be negative?

Absolutely. This usually happens due to “shiny object syndrome.” If you subscribe to 5 different tools, pay for all of them, but your team never actually adopts them, your AI ROI is -100%. You lost all your money. Training is the variable that prevents negative ROI.

Is AI worth it for a one-person business (Solopreneur)?

Yes, in fact, the AI ROI is often highest for solopreneurs. Since you have limited hours, any tool that acts as a “second employee” for $20/month has infinite leverage. It allows you to scale without the headache of payroll.

The Opportunity Cost of Inaction

We have crunched the numbers. We have looked at the formulas. We have seen that when implemented correctly, AI ROI is not just a buzzword, it is a tangible financial driver.

But there is one final cost we haven’t discussed: Opportunity Cost.

What is the cost of not doing this?

If your competitor is using AI to reply to leads in 5 seconds while you take 5 hours, you are losing money.

If your competitor is writing 50 blog posts a month while you write 4, you are losing market share.

If your competitor is automating their invoicing while you pay a bookkeeper to type manually, you are losing margin.

The risk today is not that you will calculate a low AI ROI. The risk is that you will sit on the sidelines while your competition optimizes their entire operation.

You don’t need to transform your whole business overnight. Start small. Pick one workflow, maybe it is your customer support, maybe it is your social media writing. Measure the baseline time it takes today. Deploy the tool. Then, in 30 days, run the math we discussed in this article.

Innovation is one of my core values because it is the only way to stay alive in business. Data integrity is the only way to measure that survival. Combine them, and you have a roadmap for the future.