In the world of online shopping, price is everything. For business owners, setting the right price is a critical decision that can make or break their success. Get it right, and you see sales and profits grow. Get it wrong, and you might as well be invisible. For years, most businesses used a simple method: set a price and stick with it. But today, with the power of data and smart technology, pricing has become a science. Two advanced strategies you will hear about constantly are dynamic pricing and personalized pricing. Many people use these terms as if they mean the same thing, but this is a critical mistake. Understanding the fundamental difference is essential for any modern business.

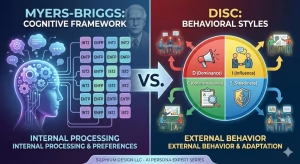

So, let’s settle the great dynamic vs. personalized pricing debate right from the start. They are not the same. The key difference is simple: dynamic pricing changes for everyone based on market factors, like how many people want an item. Personalized pricing changes for you, specifically, based on your own data and behavior. One strategy looks outward at the market, while the other looks inward at the individual customer.

Throughout this article, we will explore this crucial distinction, breaking down how each strategy works, where you see it in action, and how you can decide which, if any, is right for your e-commerce business.

What is Dynamic Pricing? Pricing Based on Market Variables

Let’s begin by focusing on dynamic pricing. You have likely seen this in action many times, even if you did not know what it was called. Dynamic pricing is also known as surge pricing, demand pricing, or real time pricing. At its most basic, it is a strategy where the price of a product or service changes in response to real time information from the market. The key thing to remember is that at any single moment, the price is the same for every single customer. If you and your friend look at the same product online at the same second, you will both see the exact same price.

How does it actually work? Imagine a store owner who is incredibly aware of everything happening around them. They know exactly how many items they have in stock, what their competitors are charging for the same item, what time of day it is, and even if it is a holiday. This store owner uses all of this outside information to adjust their prices. When a product becomes very popular and starts selling out, the owner raises the price to match the high demand.

When a competitor down the street has a big sale, the owner might lower their prices to stay competitive. Dynamic pricing automates this entire process using computer programs called algorithms.5 These algorithms watch the market 24/7 and make price changes automatically.

The data these programs use includes a wide range of market factors. It looks at competitor prices, tracking them constantly to make sure a price is competitive. It analyzes supply and demand; if inventory is low and demand is high, prices go up. If inventory is high and demand is low, prices might go down to encourage sales. Time is another factor.

For example, the price of a movie ticket might be cheaper for a showing on a Tuesday afternoon than on a Saturday night. Even the season can be a factor, like how the price of a winter coat is much higher in October than it is in April. All of this information is processed to find the best possible price at that moment. The constant discussion of dynamic vs. personalized pricing often begins with a misunderstanding of this market-based approach.

You can see classic examples of dynamic pricing everywhere. The airline industry is perhaps the most famous user. A ticket for a flight will have a different price depending on how far in advance you book it, what time of year it is, and how many seats are left. As the plane fills up, the price for the remaining seats increases. Hotels operate in the exact same way. A room in a beach town will cost much more in the middle of summer than it will in the dead of winter.

Ride sharing apps like Uber and Lyft are another perfect example. When you open the app after a big concert or on a rainy evening, you might see a notice for “surge pricing.” This means that because so many people are requesting rides at once (high demand) and there are not enough drivers (low supply), the price for a ride temporarily goes up. This higher price encourages more drivers to get on the road to meet the demand. This is dynamic pricing in its purest form; it is reacting directly to the market.

Of course, this strategy has its benefits and its downsides. For businesses, the biggest advantage is the ability to maximize revenue. By automatically adjusting to the market, a company can be sure it is not leaving money on the table. It also allows a business to be incredibly responsive and competitive. But for customers, it can be frustrating. Seeing a price change from one hour to the next can feel unfair, even if the reasons are based on the market. This is a key point in the dynamic vs. personalized pricing comparison, as customer perception is a major factor.

What is Personalized Pricing? Pricing Based on Individual Data

Now let’s turn our attention to the other side of the dynamic vs. personalized pricing coin: personalized pricing. This strategy, sometimes called price discrimination, is much more complex and controversial. Where dynamic pricing looks at the market, personalized pricing looks directly at the individual customer. It is a strategy where a business offers a different price to different customers for the same product at the same time, based on what the business knows about them. If you and your friend look at the same product at the same time, you could be shown two completely different prices.

How is this possible? The answer is data. In today’s digital world, companies can gather a huge amount of information about their customers. Personalized pricing uses this individual data to guess how much a specific person is willing to pay. The algorithms behind this strategy are not looking at the market; they are looking at you.

The data used for personalized pricing can include many things. Your past purchase history is a big one. If you always buy brand name products and never wait for a sale, the system might learn that you are not very sensitive to price and show you the full retail price. On the other hand, if you always use coupons and only buy discounted items, it might offer you a special discount to encourage you to make a purchase.

Your browsing history is also used. If you have visited a product page five times in the last day, the system might interpret this as strong interest and keep the price high, knowing you are likely to buy. Or, it could decide to offer you a small discount to finally push you to make the purchase.

Other data points include your location. A user browsing from a wealthy neighborhood might be shown a higher price than a user from a less affluent area. Even the device you are using can be a factor. Some studies have shown that users browsing on Apple products like Macs or iPhones are sometimes shown higher prices than users on PC or Android devices, based on the assumption that Apple users may have more disposable income.

All of this information is fed into artificial intelligence and machine learning models that create a profile about you as a shopper and generate a price tailored just for you. Exploring dynamic vs. personalized pricing requires a deep dive into how this personal data is used.

Examples of personalized pricing can be a bit harder to spot because companies are not always open about using it. However, we can see versions of it in many places. Think about a loyalty program at your favorite online store. As a member, you might get exclusive access to sales or receive special coupon codes that other shoppers do not. This is a form of personalized pricing, where your loyalty and past behavior are rewarded with a better price.

Subscription services like streaming platforms often use this strategy for new customers. You might be offered a special introductory price for the first three months to get you to sign up, while an existing customer is paying the full monthly rate. This is personalizing the price based on your status as a new or existing user. Some e-commerce websites might use a more subtle approach. They might not change the price of the item itself, but they might offer you, specifically, free shipping based on your location or past buying habits, which effectively changes the total price you pay.

The benefits for a business can be enormous. By tailoring the price to each individual’s willingness to pay, a company can increase the chances of making a sale and can maximize the profit from every single transaction. It can also build loyalty by making customers feel special with exclusive offers.

However, the downsides are very serious. The biggest risk is a loss of customer trust. If customers find out they are being charged more than others for the same product simply because of who they are or how they browse, they will feel cheated. This can lead to a public backlash and can permanently damage a brand’s reputation. This is the central conflict in the dynamic vs. personalized pricing discussion.

Head-to-Head Comparison: Dynamic vs. Personalized Pricing

To truly understand the dynamic vs. personalized pricing debate, it is helpful to place them side by side and compare their core features directly. While both are advanced strategies that move beyond traditional fixed pricing, they operate on completely different principles.

Here is a simple table to make the differences clear:

| Feature | Dynamic Pricing | Personalized Pricing |

| Basis of Change | Market Factors (Demand, Supply) | Individual User Data |

| Who Sees the Price? | Everyone sees the same price at the same time. | Different users may see different prices at the same time. |

| Primary Goal | Maximize revenue based on market conditions. | Maximize revenue based on individual willingness to pay. |

| Key Technology | Real time market data analysis algorithms. | AI/ML models analyzing user profiles & behavior. |

| Main Risk | Customer frustration from price volatility. | Customer distrust, legal and ethical violations. |

Let’s expand on these points. The most fundamental difference is the basis for the price change. Dynamic pricing is impersonal; it treats all customers equally and reacts to outside forces. Think of it like the price of gasoline. It goes up and down for everyone based on the global oil market, not because of the type of car you drive. Personalized pricing is the exact opposite. It is deeply personal. It looks at your individual data and creates a price just for you. Think of it like haggling at a market, where the final price depends on the seller’s perception of you as a buyer.

This leads to the next major difference: who sees the price. With dynamic pricing, there is a level of transparency. While the price may change often, everyone has access to the same price at the same time. This feels fairer to most people. With personalized pricing, this transparency is lost. The knowledge that someone else might be getting a better deal for no clear reason is what can make customers feel angry and betrayed. The ongoing conversation about dynamic vs. personalized pricing always comes back to this issue of fairness.

Finally, the risks are different. The main risk with dynamic pricing is making customers unhappy with prices that change too frequently. They might delay a purchase hoping the price will drop, or get frustrated if they buy something only to see it become cheaper an hour later. The risk with personalized pricing is much more severe. It is not just about frustration; it is about a fundamental breach of trust and potential legal trouble. This makes the choice between dynamic vs. personalized pricing a strategic one with serious consequences.

The Role of AI and Machine Learning in Modern Pricing Strategies

Neither of these advanced pricing strategies would be possible on a large scale without the power of artificial intelligence (AI) and machine learning. These technologies are the engines that run both dynamic and personalized pricing models. But you do not need to be a computer scientist to understand the role they play.

Think of AI as a brilliant assistant who can read and understand information faster than any human ever could. For dynamic pricing, this AI assistant is constantly watching the entire market. It reads data from thousands of competitor websites, tracks inventory levels down to the last item, and monitors customer demand in real time. It can then make millions of calculations a second to determine the perfect price based on all this information. It is what allows a massive online retailer like Amazon to change the prices of millions of items every single day.

For personalized pricing, the AI assistant’s job is even more complex. Here, it is not just watching the market; it is learning about every single customer. Every time you click on a product, add an item to your cart, or make a purchase, the AI is taking notes. Machine learning is a part of AI that is particularly important here. It is the process of teaching a computer to find patterns and make predictions from data. The machine learning model learns what types of products you like, how much you usually spend, and how sensitive you are to price changes.

For example, the model might learn that “Customer A” lives in a big city, always buys the newest gadgets on the day they are released, and has a high average order value. It might predict that this customer is willing to pay a premium price. Meanwhile, it might learn that “Customer B” only visits the site when there is a sale, often abandons their shopping cart, and always uses a coupon code.

For this customer, the model might predict that a small discount is needed to close the sale. The power of AI is its ability to do this for millions of customers at once, creating a unique shopping experience for each one. This capability is what drives the modern discussion of dynamic vs. personalized pricing.

Essentially, AI and machine learning provide the brainpower for these strategies. They process massive amounts of data, identify patterns that humans would miss, and automate the entire process of adjusting prices.24 Without this technology, the choice of dynamic vs. personalized pricing would be purely theoretical for most businesses.

Implementation for WooCommerce: Tools and Best Practices

For business owners using popular e-commerce platforms like WooCommerce, these advanced pricing strategies might seem out of reach, reserved only for giant corporations. However, that is no longer the case. There are many tools and plugins available that can bring the power of intelligent pricing to online stores of any size. When considering dynamic vs. personalized pricing for your own store, it is important to start with a clear plan.

For most WooCommerce users, the easiest and safest place to start is with dynamic pricing. You can implement this using a variety of “dynamic pricing” plugins. These tools allow you to set up rules that automatically adjust prices based on certain conditions.

For example, you can create a rule that gives a 10% discount to customers who buy five or more of the same item. This is a form of dynamic pricing based on quantity. You could also set up rules that offer special pricing to certain customer roles, like giving a “Wholesale” customer a different price than a regular retail customer. While this starts to blur the line towards personalization, it is rule based and transparent, making it a safe starting point.

True, AI-driven dynamic pricing that reacts to the entire market is more complex and often requires connecting your store to a third party service. These services use AI to monitor your competitors and market demand, and then they automatically adjust your prices through a connection to your WooCommerce store. This is a more hands off approach but requires a larger investment.

When it comes to personalized pricing, you must be much more careful. Implementing true one-to-one personalized pricing is difficult and, as we have discussed, risky. A better approach for most businesses is to think in terms of “personalization through rewards.” Instead of showing different base prices, use tools that allow you to offer personalized discounts and offers.

For instance, you can use plugins that generate a unique coupon code for a customer on their birthday or reward a loyal customer with a special discount after they have spent a certain amount of money in your store. This still creates a personalized experience but frames it as a positive reward, not a hidden price change. This is a practical solution to the dynamic vs. personalized pricing dilemma for small businesses.

Regardless of which path you explore, a few best practices are key. Always start small and test your ideas. Apply a new pricing rule to only a small category of products and see how customers react. Be as transparent as possible. If you are offering a bulk discount, make it clear on the product page. Frame your special offers as a thank you for loyalty. The goal is to use these tools to build better relationships with your customers, not to trick them.

The Ethical Tightrope: Legality and Customer Trust

No discussion of dynamic vs. personalized pricing would be complete without a serious look at the ethical and legal issues involved. This is where the two strategies truly diverge, and where business owners can get into serious trouble if they are not careful.

Dynamic pricing is generally considered to be legal and is a widely accepted business practice. It has been used for decades by airlines and hotels, and customers have come to expect it. While some customers might not like that prices change, the practice is transparent in the sense that everyone is offered the same price at the same time. The main ethical issue here is one of customer satisfaction. If prices change too erratically, it can damage a brand’s reputation for being fair and stable.

Personalized pricing, on the other hand, exists in a legal and ethical gray area. Charging different people different prices for the same product could be considered illegal price discrimination in some situations, especially if the price difference is based on protected characteristics like race, gender, or religion. Furthermore, the data used to power personalized pricing is subject to privacy laws like Europe’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These laws give consumers rights over their personal data and require companies to be transparent about how they collect and use it. Using personal data to charge someone a higher price without their clear consent could lead to massive fines.

The biggest issue, however, is trust. Trust is the foundation of the relationship between a business and its customers. Personalized pricing, if discovered, can shatter that trust instantly. The feeling of being singled out and charged more because a company’s algorithm decided you could afford it is deeply unsettling for most people. It makes a customer feel like a target, not a valued partner. The potential short term profit gain from personalized pricing is rarely worth the risk of long term brand damage that comes from being seen as sneaky or unfair. This is the most important lesson in the dynamic vs. personalized pricing analysis.

Conclusion: Choosing the Right Strategy for Your Business

We have explored the complex topic of dynamic vs. personalized pricing, breaking down the core differences between these two powerful strategies. To put it simply one last time: dynamic pricing is about reacting to the market, while personalized pricing is about reacting to the individual. Dynamic pricing offers the same price to everyone at a given moment based on external factors like demand and competition. Personalized pricing uses your personal data to offer a unique price just for you.

So, which strategy is right for your business? For the vast majority of e-commerce companies, especially those building their brand and customer base, the answer is clear. Start with a smart and transparent implementation of dynamic pricing. Use it to offer competitive prices, run promotions, and reward customers for bulk purchases or loyalty. This allows you to be flexible and profitable without crossing any ethical lines. It helps you respond to the market without risking the invaluable trust of your customers.

While the allure of one-to-one personalization is strong, the legal and ethical risks associated with it are simply too great for most businesses. The future of pricing will undoubtedly involve more AI and data. But the focus should be on using that data to create more value and better experiences for customers, not to quietly charge them more. Ultimately, the most successful businesses will be those that use these powerful tools to build strong, trusting relationships. The choice in the dynamic vs. personalized pricing debate is not just about technology; it is about the kind of company you want to be.